Estate Planning

While we live: certain documents give a trusted person the power to make legal or medical...

Trusts

Trusts are a mechanism to provide for our incapacitated beneficiaries who are incapable...

Probate.

With and without a will.

Property transfer is best accomplished by

probating a will. This should be done as soon as possible after the

Testator’s death.

If one does not have a will, it is more costly to transfer property

and will take longer. There are alternate methods to accomplish

property transfer.

See the charts below to demonstrate who will

inherit your property if you have no will.

Estate Planning.

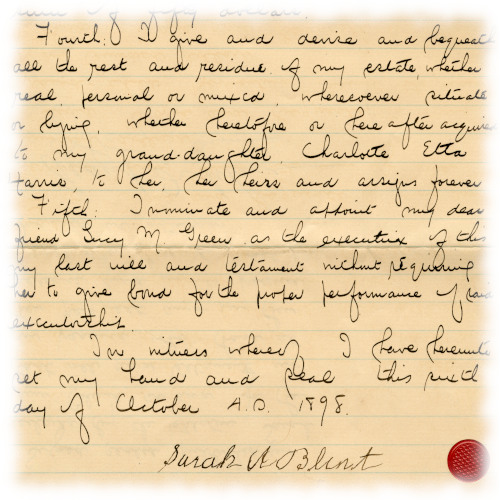

Wills & Powers of Attorney.

While we live: certain documents give a trusted person the power to make legal or medical decisions if we are unable to. Basic statutory forms include Durable Power of Attorney, Medical Power of Attorney, Guardian in the Event of Incapacity and Directive to Physicians.

After our lives on earth cease: Wills will designate who we want to be in charge of our estate (Executor) and who we want to inherit our property (Beneficiaries).

Trusts. Discretion and sensitivity.

Trusts are a mechanism to provide for our incapacitated beneficiaries who are incapable of managing funds properly, to provide for future generations, or to provide tax benefits for high-net-worth estates.

Legal matters have emotional elements attached to them which require sensitivity on the attorney’s part. Mediation can be useful in resolving conflicts when applicable.

What happens when a deceased person has left no will?

The laws of the State of Texas determine what happens to the estate.

All of the succession laws below determine the inheritors of property belonging to a deceased person who did not leave a will.

Note that this material is for educational purposes only and does not constitute legal advice. Please contact us for a consultation.Married with Child[ren]* All From Current Marriage (Death after Sep 1, 1993)

Separate Personal Property

Surviving

Spouse

Children

Community Real Property

Surviving Spouse

Separate Real Property

Estate to

Surviving

Spouse

Children

Married with Child[ren] Outside of Current Marriage (Death after Sep 1, 1993)

Separate Personal Property

Surviving

Spouse

Children

Community Real Property

Surviving

Spouse

Children

Separate Real Property

Estate to

Surviving

Spouse

Children

Married with No Children*

Community Real Property

Surviving Spouse

Separate Real Property

Spouse

Father

Mother

Separate Real Property

Spouse

Surviving

Parent

Siblings*

Equally

Separate Real Property

Surviving Spouse

Separate Real Property

Surviving

Spouse

Surviving

Parent

Separate Real Property

Surviving

Spouse

Siblings

Single or Widowed

Among Children

Father

Mother

Surviving

Parent

Siblings*

Equally

Surviving Parent

Among Siblings

Paternal

Kindred

Maternal

Kindred

* Descendants of the deceased who are otherwise heirs of their parent.

The charts above illustrate the general rules of descent and distribution under Texas law. In addition to the statutory references, see the following Texas Estates Code provisions, among others: § 201.101, Determination of Per Capita with Representation Distribution (fka per stirpes); § 201.051 et seq., Matters Affecting Inheritance (including Adoption [§ 201.054] and Collateral Kindred of Whole and Half Blood [§ 201.057])